Last year’s record-breaking purchase of Ottawa’s Constitution Square complex reunited property owner Canderel with the downtown office complex it helped construct some 25 years earlier and re-established the Montreal-based developer’s presence in the National Capital Region, industry observers say.

Last September, Canderel alongside Greystone Managed Investments and Canstone Realty Advisors purchased the three-building downtown complex from Oxford Properties and the Canada Pension Plan Investment Board for $480 million – the largest real estate transaction in Ottawa’s history.

Nico Zentil, a senior vice-president at CBRE’s national investment team whose firm represented the vendors along with RBC, says the parties involved in the transaction are among the “elite investors” in the Canadian real estate industry.

(Sponsored)

Ottawa businesses critically important to ending youth homelessness across the city

Local businesses joining United Way East Ontario’s effort to prevent and end youth homelessness not only helps build a stronger, safer, and healthier community, but gives a boost to Ottawa’s

Ottawa businesses critically important to ending youth homelessness across the city

Local businesses joining United Way East Ontario’s effort to prevent and end youth homelessness not only helps build a stronger, safer, and healthier community, but gives a boost to Ottawa’s

Speaking on the Ottawa Real Estate Show, Zentil said the acquisition was the first significant foray into Ottawa for Canstone. By contrast, the purchase brought Canderel full circle, he added.

The company developed the first two Constitution Square towers and helped fuel the growth of the Kanata North Business Park, added Shawn Hamilton, managing director of CBRE Ottawa.

“Nortel was one of their main tenants, as well as Cisco Systems and Entrust Technologies,” he said. “Much of what we see in Kanata North is attributable to (Canderel founder) Jonathan Wener and the Canderel team.”

Outlook

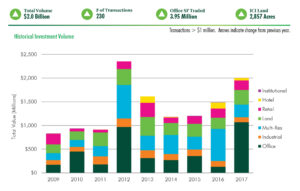

Overall investment sales in Ottawa hit a five-year high in 2017, with more than $2 billion in assets trading hands.

While CBRE is forecasting a slight decline in 2018, signs are pointing to much of last year’s momentum carrying over.

“Our feeling is that 2018 is definitely going to be another big year,” Zentil said.

Traditionally dominated by the federal government, Ottawa’s central business district is seeing a growing number of tech firms set up shop downtown.

Hamilton said one of the trends to watch will be how the city’s new landlords adjust the marketing of their buildings to this growing segment of downtown tenants.

“We’ll see new landlords with new ideas, which will ultimately help growth in our downtown core,” he said.