Two long-time leaders in the employee benefits sector are joining forces to provide business owners with workplace insurance plans that provide the flexibility and customization needed to attract new talent and accommodate employees’ needs.

Tony Conte and Dave Dickinson – who previously led Conte Financial Services Inc. and Dickinson & Associates, respectively – recently came together to form Prime Benefits Group, a custom employee benefits and pension consulting firm that puts the individual needs of its clients’ employees at the centre of its offerings, says Dickinson.

“My passion, much like Tony’s passion, is helping businesses and customers,” he says. “That is what really makes us a strong team.”

Customized benefit plans allow employees to pick and choose the coverage and services they need. While orthodontics and eyeglasses may be important for some, others may prioritize massage therapy services or prescription drug coverage, for example.

“Employers who embrace this going forward are going to have a far more engaged workforce and a competitive hiring advantage,” Conte says. “They’re essentially saying to their workers ‘I care about you, and I want to make sure your needs are being met.’”

Historically, the relatively high costs of such plans meant they were only offered by large companies with thousands of employees – putting small and medium-sized employers at a disadvantage when offering compensation packages to top talent.

But with the deep knowledge of the industry that Dickinson and Conte bring to Prime Benefits Group, the firm is able to introduce a flexible platform to mid-size companies at a reasonable cost.

And with COVID-19 having upended how and when many employees are accessing benefits, Prime’s insurance packages are more relevant than ever, says Conte.

Shifting priorities

The COVID-19 pandemic has introduced new forms of stress into the lives of many professionals, many of whom are juggling work with childcare responsibilities, dealing with a drop in income or experiencing loneliness stemming from months of social isolation.

This has more employees looking for mental health support and financial planning assistance.

Conte and Dickinson argue that it’s the role of a benefits provider to provide employers with relevant tools to navigate such periods of uncertainty.

“Human resource departments need as much support from their benefit consultants as possible,” says Dickinson. “Everything has changed and many employees are experiencing emotional, physical and financial stress, which can have a huge impact on mental health.”

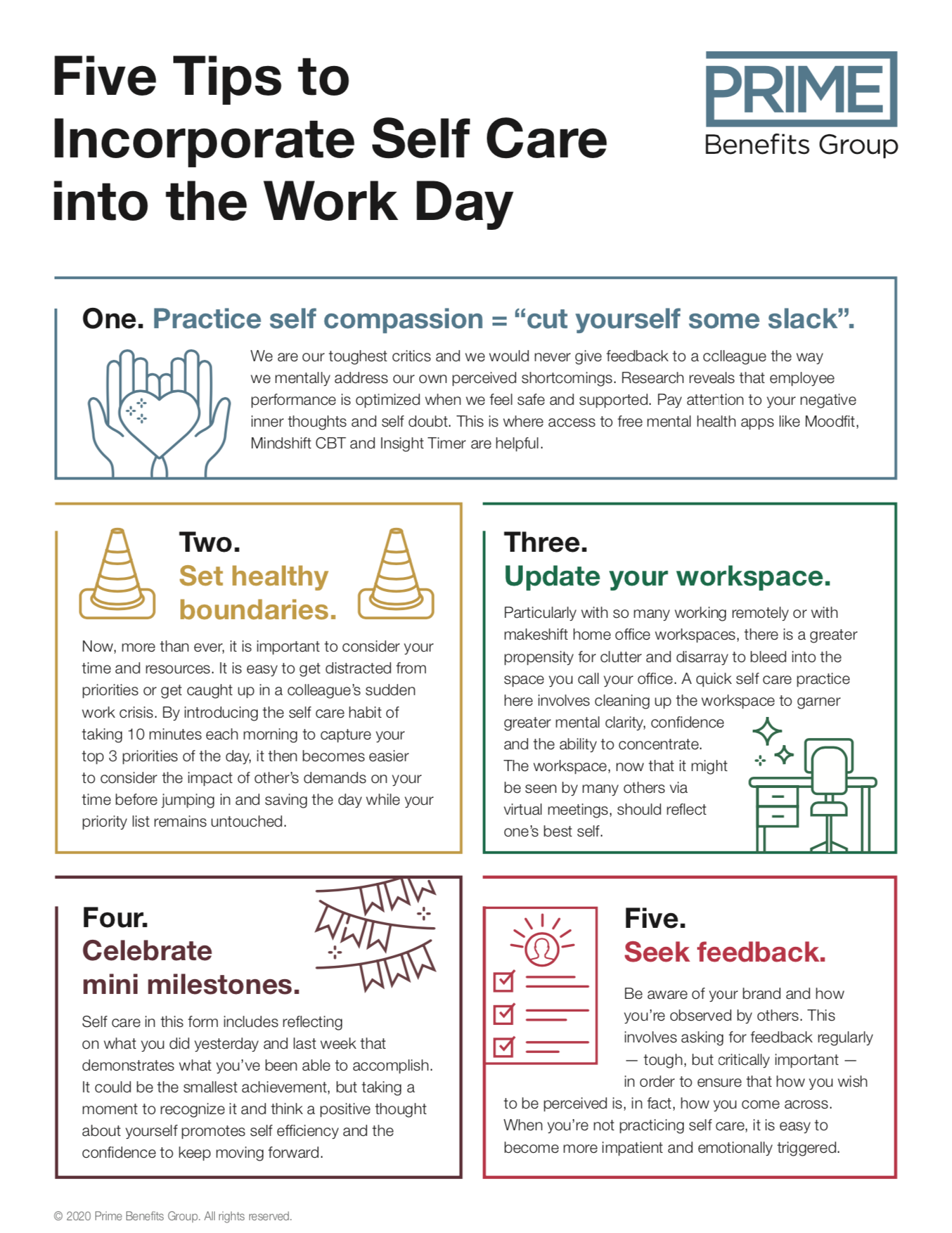

To help its clients during this period, Prime Benefits assembled a list of free relaxation, wellness and mental health apps that employers can share with staff members as part of a conversation that reminds employees of the services available through their employee assistance programs.

To help its clients during this period, Prime Benefits assembled a list of free relaxation, wellness and mental health apps that employers can share with staff members as part of a conversation that reminds employees of the services available through their employee assistance programs.

The team is also prioritizing connecting with benefit plan members to review their financial situations, helping to alleviate concerns about retirement savings.

“A lot of people are thinking down the road and asking ‘If I’m having trouble just day to day now, what does my future look like?’” Conte says. “We have been doing our best to put their fears to rest and to help them understand and get through whatever period in life they may be at.”

Book a free consultation call with Tony Conte or Dave Dickinson to discuss how your workplace can benefit from a flexible insurance plan.

613-897-7463

tony.conte@primebenefitsgroup.com | dave.dickinson@primebenefitsgroup.com